The management board

Alexandra

Alexandra PEREYRE

de NONANCOURT

Stéphanie

Stéphanie MENEUX

de NONANCOURT

Stéphane

Stéphane DALYAC

The message from the Chairman of the Management Board

In a 2024 market context marked by a decline in shipped volumes,

Laurent-Perrier has managed to maintain its market share while

preserving the value of its cuvées.

These results

reflect the quality of our wines, the growing strength of our

brands, and illustrate our long-term value creation policy.

This value creation is primarily based on our ability to

forge long-term relationships with Champagne winegrowers, to work

alongside them and on our own vineyards with a focus on a highly

qualitative and sustainable approach to winegrowing. From this

quality and our expertise, exceptional wines are born.

Laurent-Perrier is continually refining, harvest after harvest,

three unique areas of expertise on which the

brand is built: blending reserve wines, maceration of Pinot Noir,

and non-dosage.

At the same time, the group continues to invest alongside its teams,

around the world, to raise awareness, introduce and promote the

adoption of its wines through the strength of its brands.

Even though short-term prospects for the champagne

market remain uncertain, the Laurent-Perrier Group is confident that

the quality of the wines, the teams and the brands are essential

conditions for future growth.

Stéphane

DALYAC

Chairman of the Management Board.

The Supervisory Board

Patrick

Patrick Thomas

The message from the Chairman of the Supervisory Board

The Laurent-Perrier Group, under the authority of the Chairman of

the Management Board, Mr. Stéphane Dalyac, has succeeded in

maintaining its market share in a challenging environment marked by

a decline in volumes.

This performance is supported by the

efforts undertaken for several years by the Group on the quality of

its wines and its value policy.

In this uncertain geopolitical

and economic context, the 2025/2026 financial year should be

approached with vigilance

The Laurent-Perrier Group will continue to invest in the quality of

its wines, its people and the support of its brands, all over the

world.

The Supervisory Board is convinced that the

Laurent-Perrier Group has the best assets to succeed and continue

its growth

Patrick THOMAS

Chairman

of the Supervisory Board.

Vice-Chairman

Member of the Supervisory Board.

Chairman of the Audit

and Financial Communication Committee.

Chairman of the CSR Committee.

Chairman of the Remunerations

and Corporate Governance Committee.

- Marie CHEVAL - Vice-Chairman

- Jean-Marie BARILLÈRE - Member of the Supervisory Board.

- Yann DUCHESNE - Chairman of the Audit and Financial Communication Committee.

- Philippe-Loïc JACOB - Chairman of the CSR Committee.

- Eric MENEUX.

- Lucie PEREYRE de NONANCOURT.

- Jocelyne VASSOILLE - Chairman of the Remunerations and Corporate Governance Committee.

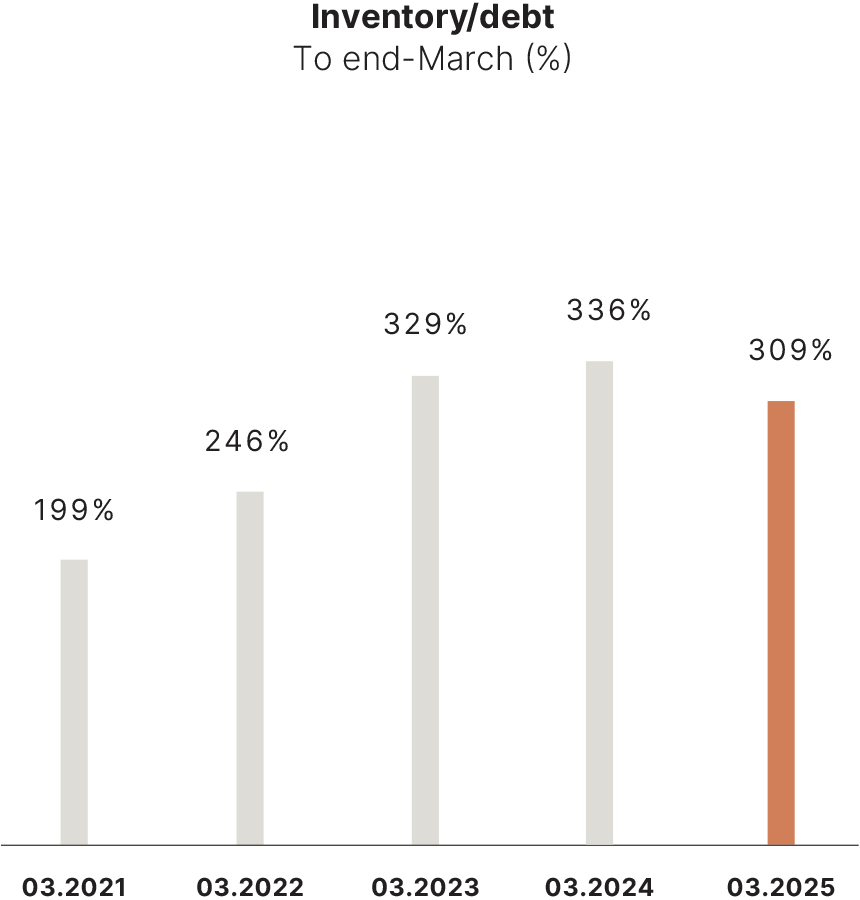

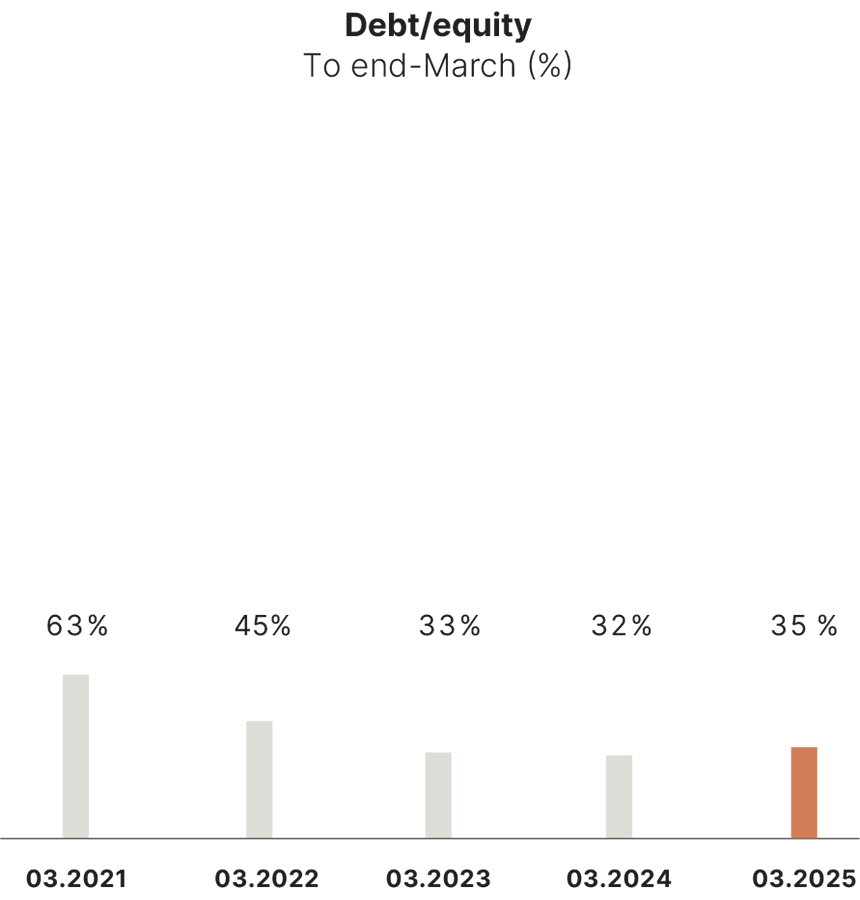

Financial ratios

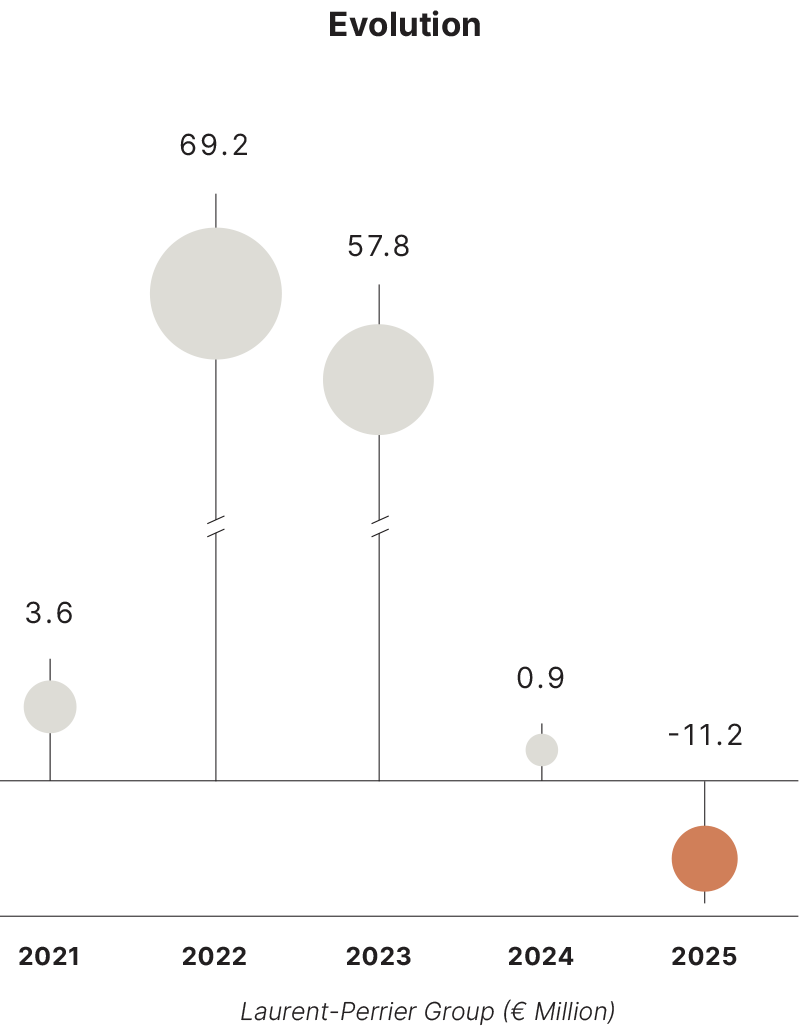

Cash Flow

from operations

Debt

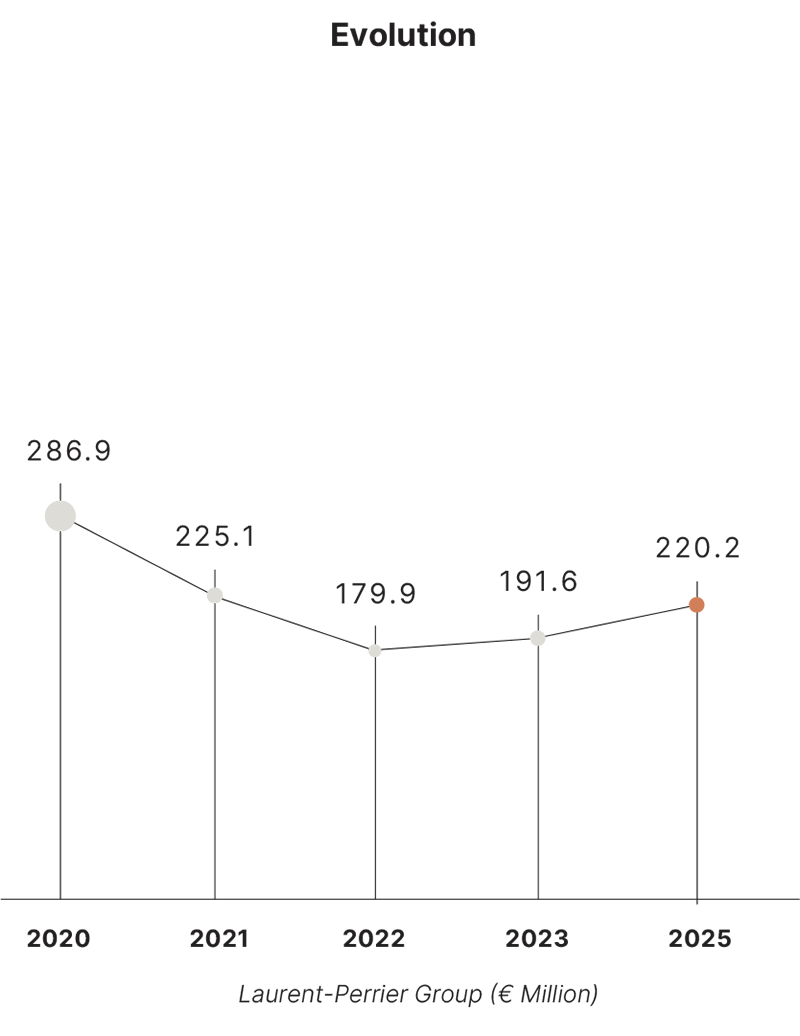

Operating account

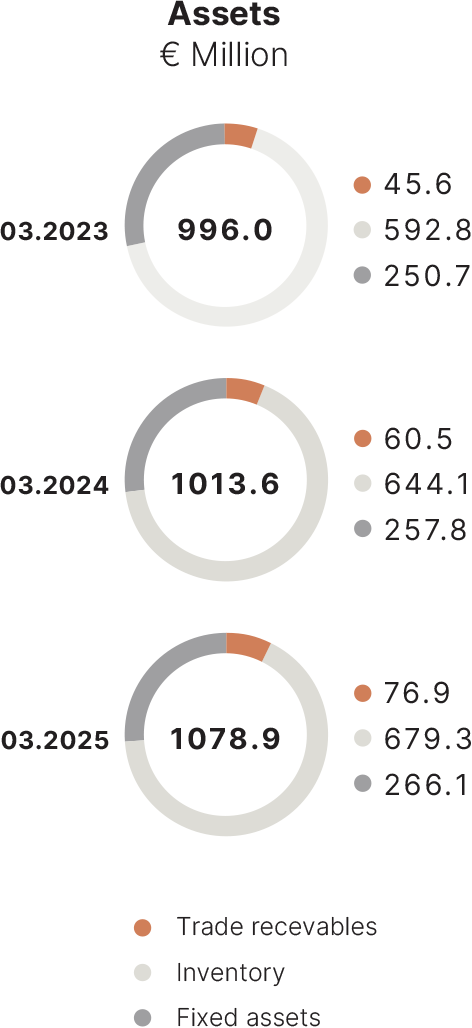

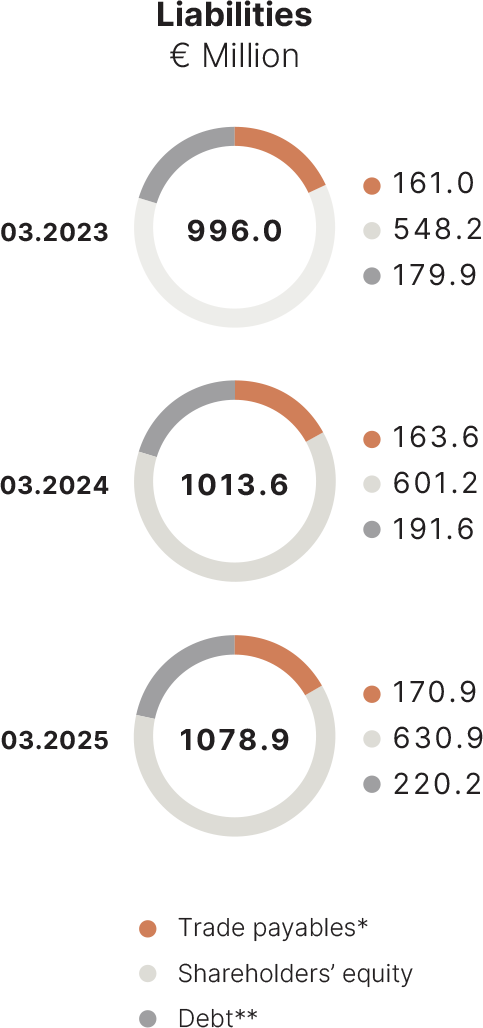

Balance sheet summary

**Net debt = financial debts - cash assets

Stock Market

Ever since it was listed on the stock exchange, Laurent-Perrier has maintened close relations with its shareholders via:

A financial website at

www.finance-groupelp.com

Two newsletters mailed,

each year to all shareholders

A team available

Tel: +33 (0)3 26 58 91 22.

Stock market data at 31st of March, 2025

-

Nominal share price:

€ 3.80

- Shares in circulation: 5,945,861

- Share price as of 31st of March 2024: € 98.60

- Market capitalization € 586,261,894.50

- CISIN code: FR0006864484

- Dividend: € 2.10 (last dividend paid in July 2024)

Capital structure

- Family: 65.17%

- Treasury shares: 1.43%

- Employees: 0.75%

- Registered institutionals: 0.26%

- Others: 32.39%

To consult the 2024 - 2025 Reference document,

go to finance-groupelp.com

Written and published by Laurent-Perrier. Design and Layout by agence Bronx.

Photo Credits: Leif Carlsson, Huge Galdones, Franck Hamel, Isabelle Harsin,

Christopher Jenney, Michel Jolyot, Vincent Junier, Photothèque Laurent-Perrier,

José Lozano, Agence Luma, Iris Velghe, Agence Weston Mills.